In the world of foreign exchange markets, the potential for the United States Dollar (USD) to embark on a significant rally has been a topic of much discussion among traders and analysts. A multitude of factors, both domestic and international in nature, have been shaping the trajectory of the USD in recent times. As investors and policymakers closely monitor these developments, the stage may be set for a perfect rally in the value of the USD in the near future.

Starting with the domestic front, the USD has been influenced by the economic policies and performance of the United States. The fiscal and monetary policies implemented by the Federal Reserve and government have played a crucial role in shaping the value of the USD. Recent developments, such as the increase in interest rates by the Federal Reserve, have signaled a tightening of monetary policy, which could potentially strengthen the USD. Additionally, the strong economic indicators and robust growth in the U.S. economy have bolstered the foundation for the USD to rally.

On the international stage, geopolitical events and global economic dynamics have also impacted the USD. The trade tensions between the United States and its major trading partners, such as China, have led to fluctuations in the value of the USD. Uncertainties surrounding Brexit, economic slowdowns in Europe and emerging markets, have all contributed to market volatility and influenced the attractiveness of the USD as a safe-haven currency.

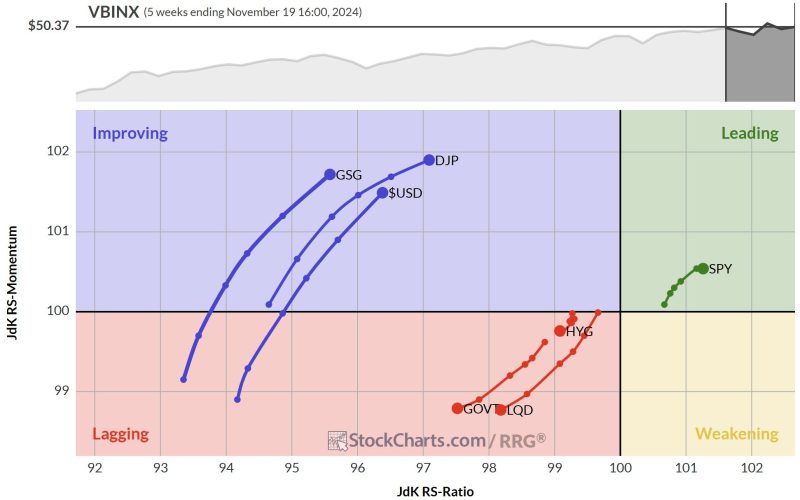

Moreover, the USD’s correlation with commodities and other assets have also played a significant role in its valuation. Traditionally, the USD and commodities such as gold have exhibited an inverse relationship. As the USD strengthens, commodity prices tend to decline, and vice versa. Therefore, any rally in the USD could have implications for global commodity markets and impact trading strategies.

Technical analysis of currency charts and trends is another tool used by traders to anticipate potential price movements in the USD. Chart patterns, support and resistance levels, and other technical indicators are closely monitored to identify potential entry and exit points in the market. Through a comprehensive analysis of technical factors, traders can augment their fundamental understanding of the USD’s outlook and make informed decisions.

In conclusion, the USD’s potential for a perfect rally is contingent on a combination of domestic and international factors. The convergence of strong economic fundamentals in the United States, geopolitical events, global economic dynamics, and technical analysis all contribute to shaping the trajectory of the USD. As market participants navigate through these complexities, staying informed and adaptable will be key to capitalizing on potential opportunities in the foreign exchange markets.