In the realm of financial markets, navigating through volatility and uncertainty requires a keen understanding of technical analysis and strategic decision-making. As the week unfolds, investors are advised to remain vigilant and focus on key levels that could provide insights into market direction. In the case of the Nifty index, maintaining composure during consolidation phases is imperative, as it sets the stage for potential breakouts or reversals.

Amidst the ebb and flow of market movements, certain levels can serve as crucial indicators of future price action. The support and resistance levels act as guiding beacons, steering investors through choppy waters and offering valuable insights into market sentiment. By keeping a watchful eye on these levels, investors can gauge the underlying strength or weakness prevailing in the market and adjust their strategies accordingly.

Additionally, the importance of volume cannot be understated in market analysis. Volume trends often precede price movements, offering early signals of potential shifts in market dynamics. A surge in volume accompanying a price breakout, for instance, can validate the strength of a given trend, while a divergence between price action and volume may signal a weakening momentum.

Furthermore, market breadth indicators can provide a holistic view of market participation and underlying strength. Monitoring the breadth of market movements across various sectors and stocks can give investors a comprehensive understanding of market health and potential divergences that may impact overall performance.

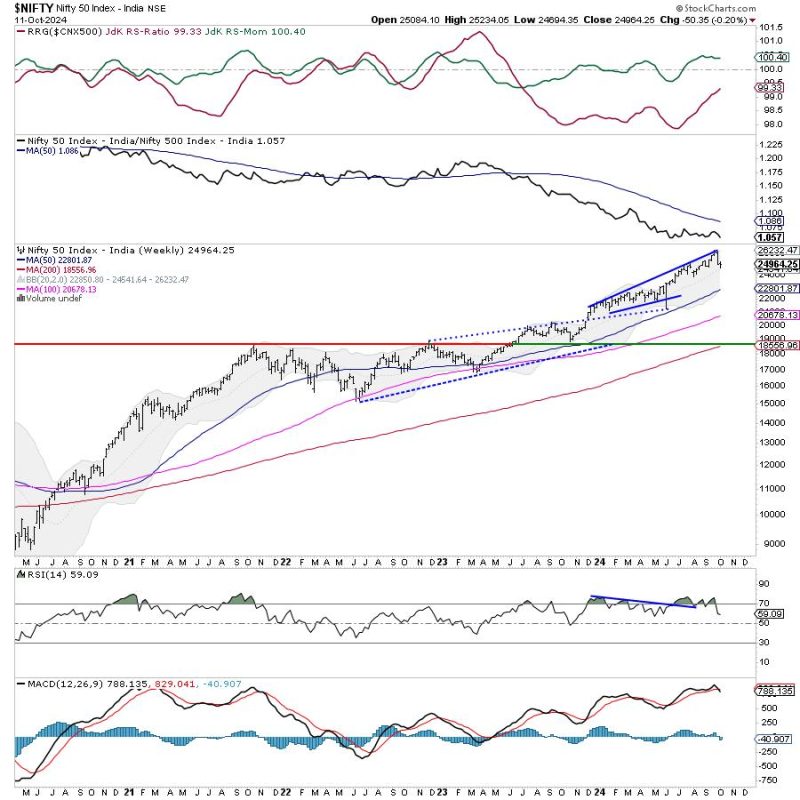

In the realm of technical analysis, oscillators and momentum indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) can offer valuable insights into overbought or oversold conditions, as well as potential trend reversals. By incorporating these indicators into their analysis, investors can fine-tune their entries and exits, maximizing returns and minimizing risks.

As market participants navigate the challenges and opportunities presented by the evolving market landscape, staying abreast of key technical levels, volume trends, market breadth, and oscillators can provide a strategic edge in decision-making. By arming themselves with a thorough understanding of market dynamics and employing a disciplined approach to analysis, investors can navigate the tumultuous waters of financial markets with confidence and precision.