Sure, here’s a unique article structured based on the reference link you provided:

—

### The Impact of Rate Cuts on Stock Performance: A Comprehensive Analysis

#### Understanding the Relationship Between Rate Cuts and Stock Market Performance

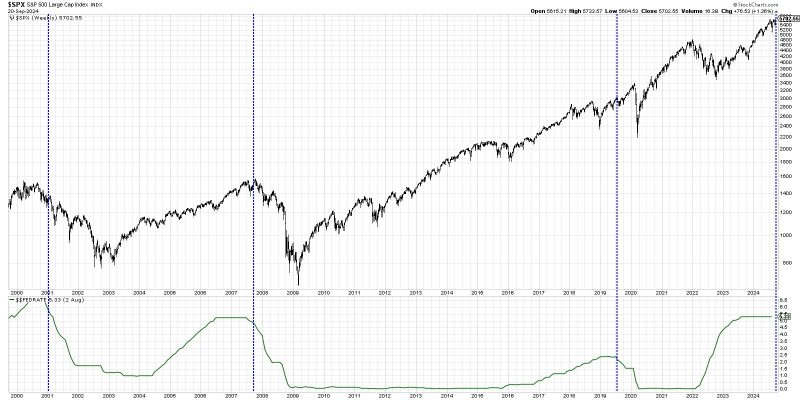

When it comes to analyzing the impact of rate cuts on stock market performance, investors are often divided between being bullish or bearish. The truth is, the relationship between rate cuts and stock performance is complex and multifaceted. While rate cuts can stimulate economic growth and boost stock prices in the short term, their long-term effects are not always as clear-cut.

#### Short-Term Market Reactions to Rate Cuts

Historically, rate cuts by central banks have often led to a surge in stock prices in the short term. This is because lower interest rates make borrowing cheaper, encourage spending, and stimulate economic activity. As a result, investors tend to react positively to rate cuts, driving stock prices up in anticipation of increased company earnings.

#### The Role of Market Sentiment and Expectations

However, the stock market is not only influenced by rate cuts themselves but also by investors’ sentiments and expectations surrounding these cuts. If market participants view rate cuts as a sign of economic weakness or impending recession, stock prices may actually decline despite the stimulus provided by lower interest rates.

#### Long-Term Implications of Rate Cuts on Stock Performance

While rate cuts can provide a short-term boost to stock prices, their long-term effects are more nuanced. Excessive or prolonged rate cuts can lead to concerns about inflation, currency devaluation, and unsustainable asset bubbles. As a result, the initial positive impact of rate cuts on stock performance may be outweighed by broader economic challenges in the long run.

#### Diversification and Risk Management in a Changing Rate Environment

Given the uncertainties surrounding the impact of rate cuts on stock performance, it is essential for investors to adopt a diversified and risk-managed approach to their portfolios. Diversification across asset classes and geographical regions can help mitigate the risks associated with interest rate fluctuations and ensure a more resilient investment strategy in a changing rate environment.

#### Conclusion

In conclusion, while rate cuts can have a significant impact on stock market performance, the relationship between the two is multifaceted and influenced by various factors including market sentiment, economic conditions, and policy decisions. By understanding the complexities of this relationship and adopting a prudent investment strategy, investors can navigate the challenges and opportunities presented by rate cuts to achieve long-term financial success.

—

This article provides a comprehensive analysis of the relationship between rate cuts and stock market performance, highlighting the short-term market reactions, long-term implications, and the importance of diversification and risk management in a changing rate environment.