The article Equities Say Go Fish: How Healthy Are the Markets? on GodzillaNewz discusses the current state of the equity markets and raises important questions about their health. In this article, we will delve deeper into the key points raised in the original piece and explore the complexities of evaluating the health of the markets.

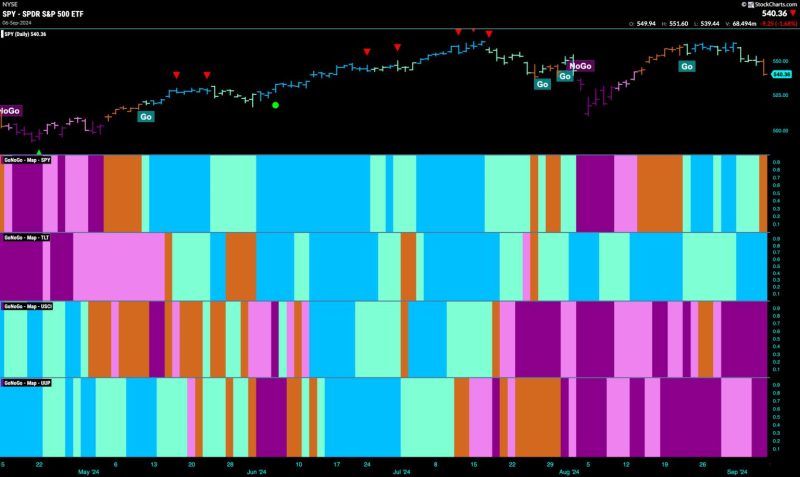

One of the central ideas presented in the original article is the concept of market indicators as a tool for assessing market health. Market indicators are essential metrics that provide insights into the overall performance of the equity markets. Some common indicators mentioned in the article include stock prices, market volatility, and economic data. These indicators offer valuable information to investors and analysts to gauge the stability and growth potential of the markets.

Stock prices are a fundamental indicator of market health, reflecting the collective sentiment of investors. A rising stock market generally indicates confidence and optimism, while a falling market may signal uncertainty or pessimism. However, it is crucial to consider other factors such as market volatility when interpreting stock prices. High volatility can indicate increased risk and uncertainty in the markets, potentially leading to sharp price fluctuations.

Economic data is another vital indicator that provides valuable insights into the broader economic environment and its impact on the equity markets. Key economic indicators such as GDP growth, employment rates, and consumer spending can influence market dynamics. Positive economic data often correlates with market expansion, while negative data can raise concerns about economic stability.

In addition to market indicators, the article also touches upon the role of central banks and government policies in shaping market conditions. Central banks play a crucial role in influencing interest rates, inflation, and monetary policy, which can have a significant impact on the markets. Government policies related to fiscal stimulus, trade agreements, and regulatory reforms can also shape market sentiment and overall health.

Furthermore, the article highlights the importance of diversification and risk management in navigating market uncertainties. Diversifying investment portfolios across different asset classes and regions can help mitigate risks and protect against market volatility. Risk management strategies such as setting stop-loss orders and maintaining a long-term investment perspective are essential tools for investors to safeguard their portfolios.

Overall, assessing the health of the equity markets is a multifaceted process that requires a comprehensive understanding of market indicators, economic trends, and regulatory factors. By incorporating these key elements into their analysis, investors can make informed decisions and adapt to changing market conditions. Staying vigilant, diversified, and well-informed is essential for navigating the complexities of the financial markets and achieving long-term investment success.