In the recent article from Godzilla Newz, analysis indicates that the Nifty index in the Indian stock market is showing early signs of potential disruption to its current uptrend. This raises a caution flag for investors and traders as they navigate the market in the week ahead.

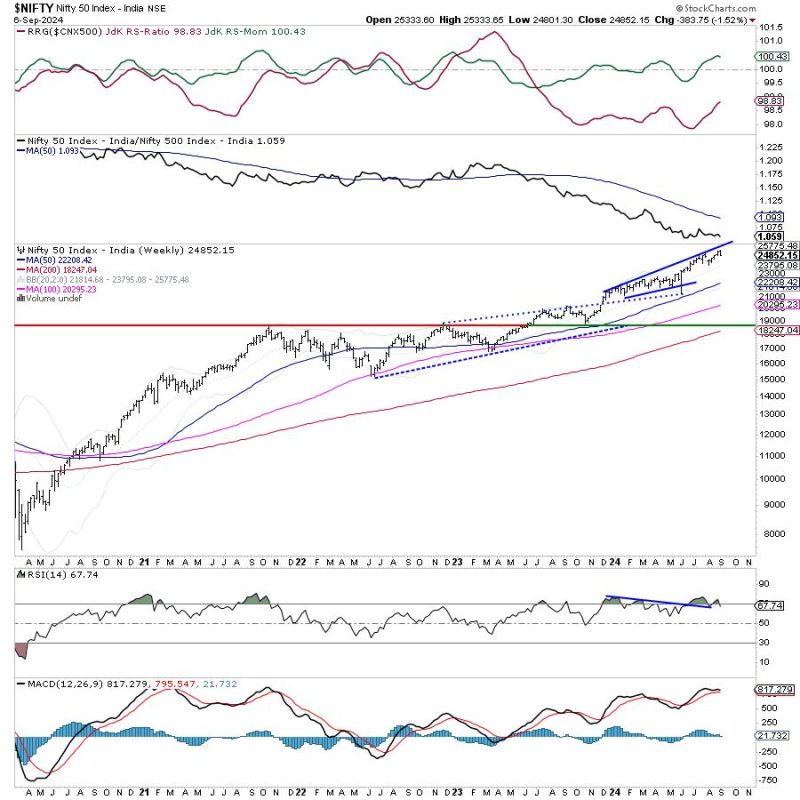

Technical analysis plays a crucial role in understanding market trends and potential shifts in direction. Analysts are pointing out that the Nifty index’s structure is displaying signs of weakness, hinting at a possible reversal from the ongoing upward trend. This information is vital for market participants looking to make informed decisions about their investments.

The article emphasizes the importance of staying cautious in such situations. While no one can predict market movements with absolute certainty, keeping a close eye on indicators and trends can help investors mitigate risks and adjust their strategies accordingly. Risk management is a critical aspect of successful trading and investing, especially in volatile markets.

Furthermore, the article highlights the significance of monitoring key support and resistance levels in the Nifty index. These levels provide valuable insights into the market sentiment and can serve as important reference points for traders. By paying attention to these levels, investors can better gauge the strength of the current trend and anticipate potential price movements.

In addition to technical analysis, external factors such as economic data releases, geopolitical events, and global market trends can also impact the Nifty index. It is essential for investors to stay informed about these developments and consider their potential implications on the market. A well-rounded approach to market analysis involves considering both technical and fundamental factors.

As the week unfolds, investors are advised to exercise caution and closely monitor the Nifty index for any further signs of a potential trend reversal. By staying informed, practicing risk management, and remaining adaptable to changing market conditions, investors can navigate the market more effectively and make informed decisions to protect their investments.