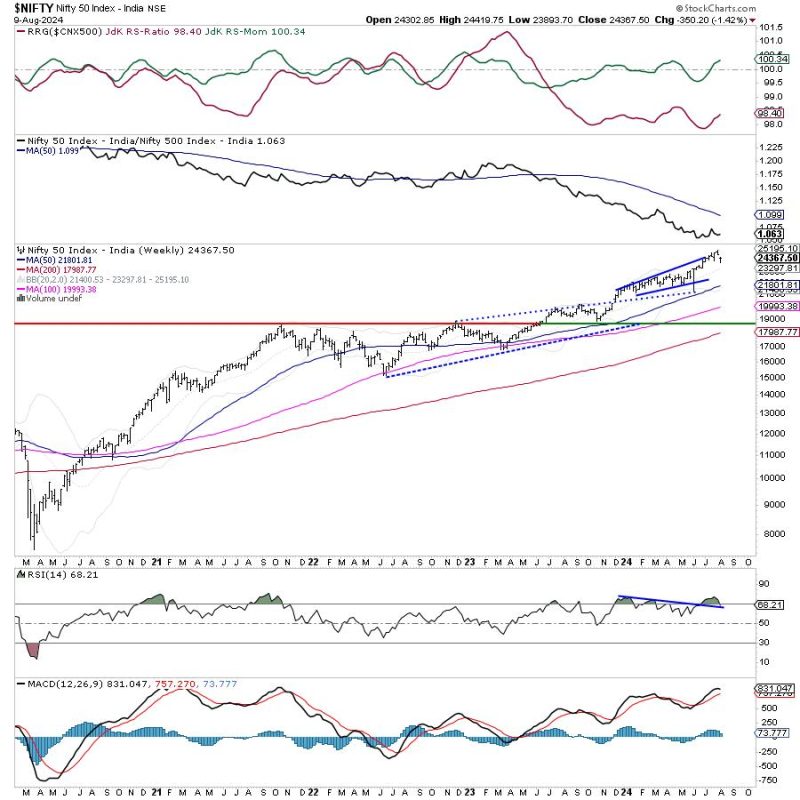

As the Nifty continues to exhibit a cautious stance, market participants are closely monitoring the formation of a defensive setup. This defensive undertone is evident as key levels are being closely watched to identify potential trends in the market.

Technical analysts are paying particular attention to certain levels that play a crucial role in determining the market direction. These levels are instrumental in creating a roadmap for traders and investors to navigate the complexities of the market.

The Nifty’s performance this week is expected to be influenced by these key levels, signaling potential shifts in market sentiment. Traders are advised to stay vigilant and make informed decisions based on the evolving market dynamics.

Keeping a close eye on the market landscape becomes imperative during such tentative phases. Traders must be well-prepared to adapt to changing market conditions and adjust their strategies accordingly.

The development of a defensive setup necessitates a proactive approach from traders, as the market remains susceptible to sudden shifts in sentiment. Understanding the significance of key levels and their impact on market movements is essential for making well-informed trading decisions.

In conclusion, the Nifty’s tentative stance and the emergence of a defensive setup underline the importance of thorough analysis and strategic decision-making in navigating the market. By closely monitoring key levels and staying attuned to market developments, traders can position themselves effectively to capitalize on potential opportunities while managing risks appropriately.