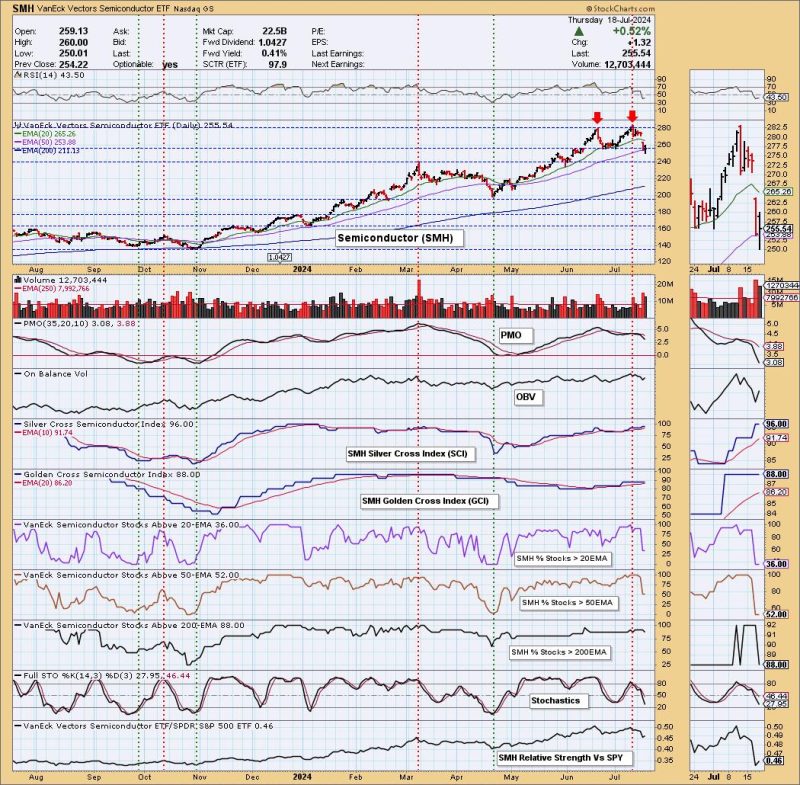

The analysis presented in the reference link highlights a potential double top pattern forming on the SMH (VanEck Semiconductor ETF), indicating a potential trend reversal in the semiconductor sector. The double top pattern is a bearish technical analysis signal that suggests a possible reversal of an uptrend. In this article, we will delve deeper into the concept of double top patterns, their significance in technical analysis, and how traders and investors can use this information to make informed decisions.

Understanding Double Top Pattern

A double top pattern is a bearish reversal pattern that occurs after an extended uptrend. The pattern consists of two peaks at roughly the same price level, with a trough in between. The first peak represents the primary high, followed by a decline to the trough, and then a recovery to form the second peak. The pattern is confirmed when the price breaks below the trough, indicating a potential trend reversal.

Significance in Technical Analysis

Double top patterns are significant in technical analysis as they signal a shift in market sentiment from bullish to bearish. The pattern reflects a struggle between buyers and sellers, with the second peak failing to surpass the first peak, indicating weakening bullish momentum. Once the price breaks below the trough, it confirms the pattern and suggests a high probability of a downward trend reversal.

Implications for Semiconductor Sector

In the context of the semiconductor sector, the formation of a double top pattern on the SMH ETF suggests a potential reversal of the previous uptrend in semiconductor stocks. Semiconductors are a key component of the technology sector, and their performance often reflects broader market trends. A bearish reversal in semiconductors could have implications for the overall market sentiment and tech-heavy indices.

Trading and Investment Strategies

For traders and investors, recognizing a double top pattern on the SMH ETF can present both risks and opportunities. Those holding long positions in semiconductor stocks may consider taking profits or implementing hedging strategies to protect against potential downside risk. On the other hand, traders looking to capitalize on the bearish reversal may consider short-selling strategies or buying put options on semiconductor ETFs.

Conclusion

In conclusion, the formation of a double top pattern on the SMH ETF signals a potential trend reversal in the semiconductor sector, with implications for broader market sentiment. Understanding and identifying such patterns can help traders and investors make informed decisions and manage risk effectively. By applying technical analysis tools and monitoring key price levels, market participants can navigate volatile market conditions and capitalize on trading opportunities.