In a world characterized by constant market fluctuations and economic uncertainties, investors are constantly on the lookout for signs that may indicate a shift in sentiment. The concept of market topping is a crucial one in this regard, as it denotes the peak of a market cycle before a potential downturn. While predicting market tops is never an exact science, certain indicators and signals can provide valuable insights for investors looking to make informed decisions.

One key indicator that the market may be topping is the overvaluation of stocks. When stock prices reach unsustainable levels relative to their underlying earnings and fundamentals, it could be a sign that investors are overly optimistic and that a correction may be on the horizon. Metrics such as the price-to-earnings ratio and price-to-book ratio can help investors gauge the valuation of the overall market and individual stocks.

Another signal that the market may be topping is excessive bullishness among investors. When optimism reaches extreme levels and investors become complacent about potential risks, it may indicate that the market is due for a pullback. Surveys of investor sentiment and the level of margin debt in the market can provide insights into the prevailing mood among market participants.

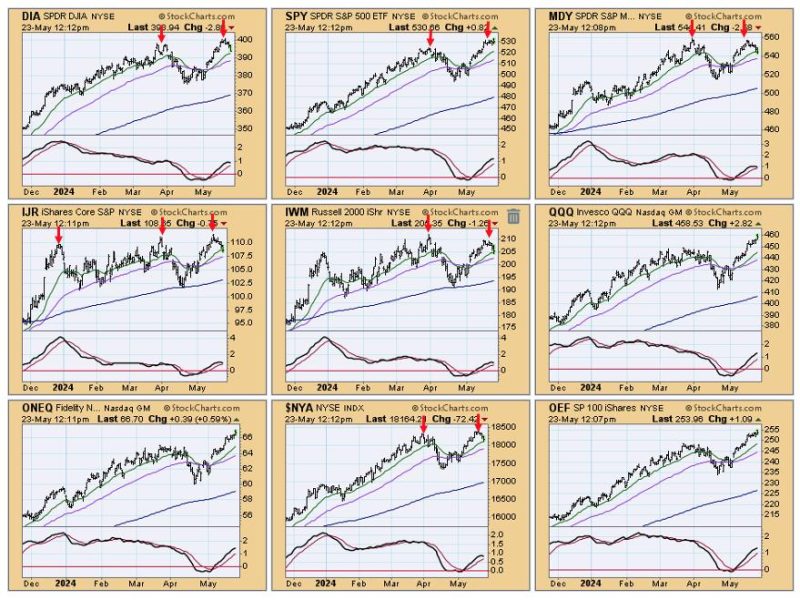

Technical analysis can also be a valuable tool for identifying potential market tops. Patterns such as double tops, head and shoulders formations, and divergences between price and technical indicators can signal impending reversals in the market. By studying historical price patterns and market dynamics, technical analysts can identify key levels of support and resistance that may indicate potential turning points in the market.

In addition to these indicators, macroeconomic factors can also play a role in signaling a market top. Factors such as rising interest rates, inflationary pressures, and geopolitical uncertainties can all contribute to market volatility and potentially trigger a downturn. Keeping a close eye on economic data releases, central bank policies, and geopolitical developments can help investors anticipate potential risks to the market.

While no single indicator can reliably predict market tops, a combination of fundamental analysis, sentiment indicators, technical analysis, and macroeconomic factors can provide a more comprehensive view of market conditions. By staying informed and vigilant, investors can better position themselves to navigate changing market dynamics and make informed investment decisions.