In the world of stock market analysis, traders continually seek out reliable indicators to inform their investment decisions. One such indicator is the Silver Cross Buy Signal, which has garnered significant attention and respect among investors. This signal, generated when the 50-day moving average crosses above the 200-day moving average, is seen as a bullish sign for a stock or index.

Today, investors are closely observing the Dow Jones Industrial Average (DIA) and the Russell 2000 (IWM) for the occurrence of Silver Cross Buy Signals. Let’s delve into the details of these signals for each index and explore the potential implications for traders.

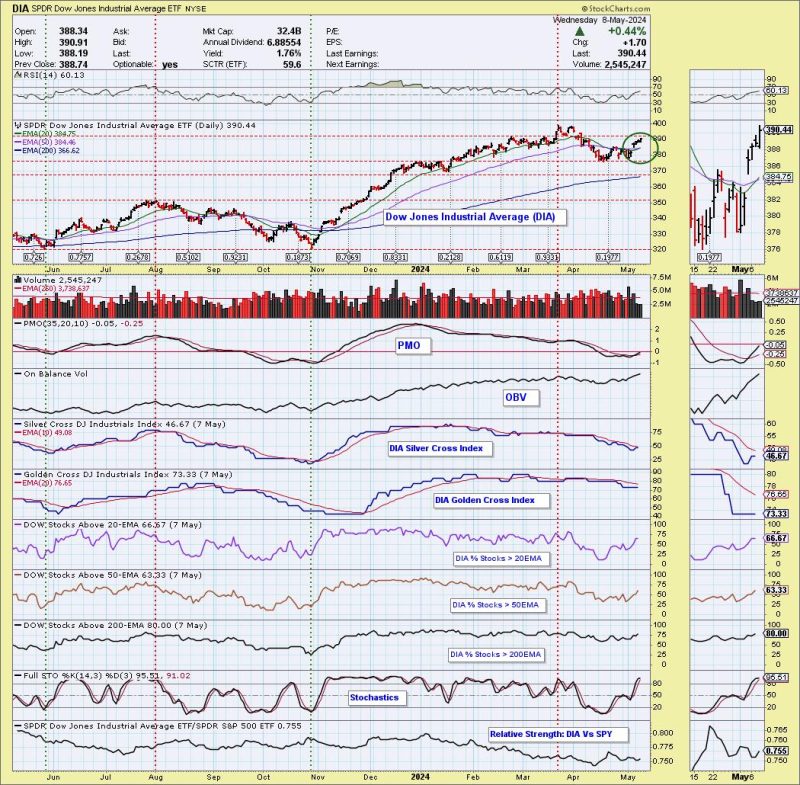

Dow Jones Industrial Average (DIA):

The Dow Jones Industrial Average, a benchmark index comprising 30 large-cap stocks, is a key indicator of the overall health of the stock market. Recently, the DIA exhibited a Silver Cross Buy Signal, with the 50-day moving average surpassing the 200-day moving average. This development has caught the attention of technical analysts and investors alike.

The emergence of a Silver Cross Buy Signal on the DIA suggests improving market sentiment and optimism among investors. Traders who rely on technical analysis may interpret this signal as a bullish indication for the index, potentially leading to increased buying pressure and upward price momentum in the near term.

Russell 2000 (IWM):

In contrast to the large-cap focus of the Dow Jones Industrial Average, the Russell 2000 index tracks the performance of small-cap stocks in the United States. As small-cap stocks are often considered riskier and more volatile than their larger counterparts, movements in the Russell 2000 index can provide valuable insights into market sentiment.

Recently, the Russell 2000 (IWM) also exhibited a Silver Cross Buy Signal, with the 50-day moving average crossing above the 200-day moving average. This event has sparked interest among traders and analysts, signaling a potential shift in momentum for small-cap stocks.

For investors tracking the Russell 2000 index, the emergence of a Silver Cross Buy Signal may signal a renewed interest in small-cap equities and a potential uptrend in prices. Traders monitoring this signal may adjust their investment strategies accordingly, anticipating potential opportunities in the small-cap segment of the market.

In conclusion, the observation of Silver Cross Buy Signals on key indices such as the Dow Jones Industrial Average and the Russell 2000 can provide valuable insights for traders and investors. These signals, based on the relationship between short-term and long-term moving averages, serve as technical indicators of market trends and sentiment.

As market participants analyze and interpret these signals, they may adjust their investment strategies to capitalize on potential opportunities in the evolving market environment. By staying attuned to key indicators such as Silver Cross Buy Signals, traders can enhance their decision-making process and navigate the complexities of the stock market with greater confidence and insight.