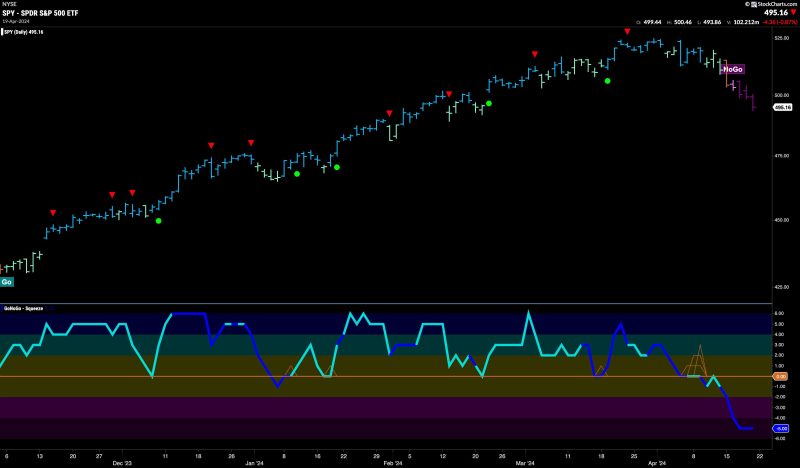

Equities Struggle in Strong No-Go as Materials Try to Curb the Damage

The global equities market has been facing a tumultuous period in recent times, marked by strong volatility and uncertainty. In a scenario where investors are on edge, trying to navigate the choppy waters of the financial market, equities have struggled to maintain stability and growth.

A notable trend that has emerged is the struggle of equities to gain traction in what can be aptly termed as the strong no-go environment. This environment is characterized by a lack of clear direction, market indecision, and conflicting signals that make it challenging for equities to make significant advances.

Despite the challenging conditions, materials have emerged as a sector that is attempting to curb the damage and provide some semblance of support for equities. The materials sector, which encompasses industries such as mining, construction, and manufacturing, plays a vital role in the global economy and is often considered a bellwether for broader economic trends.

One of the key factors that have contributed to the materials sector’s resilience amid the turbulent market conditions is the sustained demand for essential commodities such as industrial metals and minerals. These raw materials are critical inputs for various industries and infrastructure projects, driving demand and providing a stable revenue stream for materials companies.

Moreover, the shift towards sustainable and green technologies has also bolstered the materials sector, with increasing demand for materials used in renewable energy infrastructure, electric vehicles, and energy-efficient buildings. As the world transitions towards a more sustainable future, materials companies that cater to these sectors are well-positioned to benefit from the ongoing global trends.

However, the path to recovery for equities remains fraught with challenges, as geopolitical tensions, inflation concerns, and supply chain disruptions continue to weigh on market sentiment. In such a complex and unpredictable environment, investors are advised to exercise caution and adopt a diversified investment strategy to mitigate risks and capitalize on potential opportunities.

In conclusion, the equities market is currently navigating through turbulent waters, with materials emerging as a sector that offers some respite amid the prevailing uncertainties. While the road ahead may be bumpy, adopting a long-term perspective and staying informed about market developments can help investors make sound decisions and weather the storm effectively.