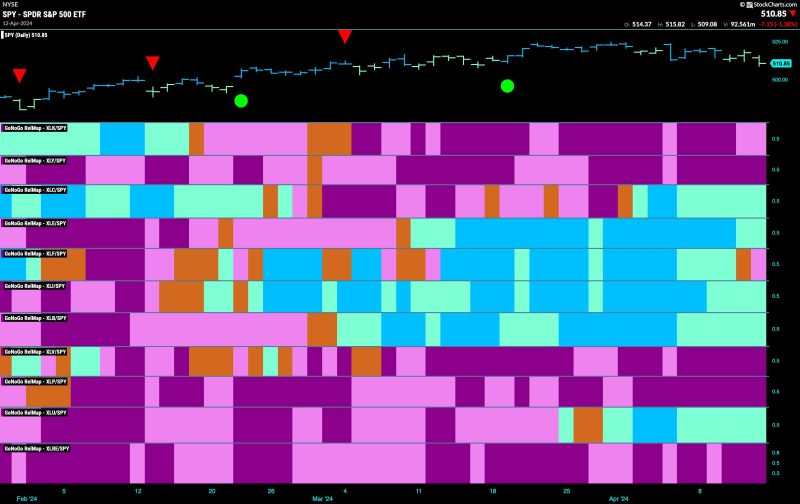

Equity Markets Struggling to Maintain Go Trend as Industrials Attempt to Lead

Equity markets are currently facing a precarious situation as they grapple with various challenges that are hindering their ability to maintain the upward Go Trend observed in recent months. Amidst the uncertainty and volatility, the industrial sector has emerged as a focal point, attempting to provide leadership and stability in this turbulent market environment.

One of the key factors contributing to the struggle of equity markets is the ongoing global economic uncertainties. The geopolitical tensions, trade conflicts, and macroeconomic imbalances have created a sense of unease among investors, leading to fluctuations and indecision in the markets. The ever-evolving situation in key economies such as the United States, China, and Europe has added an extra layer of complexity to the market dynamics, making it challenging for investors to assess and react to changing circumstances effectively.

Furthermore, the resurgence of inflationary pressures has added another dimension to the market’s challenges. The rising costs of goods and services, coupled with an environment of tightening monetary policies, have raised concerns about the sustainability of the current growth trajectory. Inflationary risks have weighed on investor sentiment, leading to a reevaluation of investment strategies and asset allocations.

In the face of these challenges, the industrial sector has emerged as a potential beacon of hope for the equity markets. Industrials, encompassing a wide range of companies involved in manufacturing, construction, and infrastructure development, have shown resilience and relative strength amidst the broader market uncertainties. The focus on infrastructure spending, green initiatives, and technological advancements has boosted the prospects of industrial companies, positioning them as attractive investment opportunities in a constantly evolving market landscape.

Moreover, the industrial sector’s strategic importance in driving economic growth and recovery post-pandemic has garnered increased attention from investors seeking long-term value and stability. The prospect of increased government spending on infrastructure projects and a renewed emphasis on domestic manufacturing capabilities have further bolstered the outlook for industrial companies, providing a solid foundation for potential growth and profitability.

Despite the challenges and uncertainties confronting the equity markets, the industrials’ attempts to lead and provide stability offer a ray of hope for investors navigating the current market environment. By focusing on companies with strong fundamentals, resilient business models, and a strategic vision for the future, investors can position themselves to navigate the complexities of the market and capitalize on the opportunities presented by the evolving industrial landscape. As the equity markets continue to grapple with uncertainty, the industrials’ efforts to lead amidst the tumult provide a roadmap for investors seeking to navigate the turbulent waters of the financial markets with confidence and resilience.