In recent months, the stock market has experienced significant volatility as investors navigate the ongoing challenges posed by the global pandemic and other economic uncertainties. One notable trend that has emerged is the shift towards value stocks outperforming growth stocks. While this change may present opportunities for some investors, there are several downside risks that should be considered when evaluating investment strategies in the current market environment.

1. **Interest Rate Hikes**: One of the primary concerns for investors is the potential for interest rate hikes by central banks. An increase in interest rates could lead to higher borrowing costs for companies, which could negatively impact their profitability and stock prices. Additionally, higher interest rates may make fixed-income investments more attractive relative to stocks, leading to a rotation out of equities.

2. **Inflationary Pressures**: Inflation has been a hot topic in recent months as supply chain disruptions and rising commodity prices have put upward pressure on prices. If inflation continues to accelerate, it could erode the purchasing power of consumers and erode corporate profit margins. This could dampen investor sentiment and lead to a sell-off in the stock market.

3. **Geopolitical Risks**: Geopolitical tensions around the world, including trade disputes, political instability, and conflicts, can have a significant impact on global markets. Uncertainty stemming from these factors can lead to increased market volatility and investor anxiety, causing a flight to safer assets and potentially driving down stock prices.

4. **Valuation Concerns**: As value stocks outperform growth stocks, some sectors may become overvalued relative to their fundamentals. Investors should be cautious of investing in companies with high valuations, as a correction could lead to significant losses. Conducting thorough research and financial analysis is crucial to identify companies that are trading at reasonable valuations.

5. **Market Sentiment Shifts**: Investor sentiment can change rapidly in response to news events, economic data releases, and other factors. A sudden shift in sentiment could trigger a sell-off in stocks, particularly those that have experienced rapid price appreciation. It is important for investors to stay informed and react swiftly to changing market conditions.

6. **Regulatory Changes**: Changes in regulations and government policies can have a profound impact on specific industries and companies. Investors should closely monitor legislative developments that could affect the companies in which they are invested and prepare accordingly for potential disruptions to their business operations.

7. **Corporate Earnings Volatility**: Earnings reports are a key driver of stock prices, and volatility in corporate earnings can lead to price fluctuations in the stock market. Companies that fail to meet earnings expectations or provide weak guidance may see their stock prices decline, resulting in losses for investors.

8. **Liquidity Concerns**: In times of market turmoil, liquidity can dry up, making it difficult for investors to buy or sell securities at desired prices. Illiquid markets can exacerbate price volatility and increase the risk of losses for investors who need to liquidate their holdings quickly.

9. **Black Swan Events**: Unforeseen events, such as natural disasters, global pandemics, or financial crises, can have a sudden and severe impact on stock markets. While it is impossible to predict the occurrence of black swan events, investors can mitigate their risk exposure by diversifying their portfolios and implementing risk management strategies.

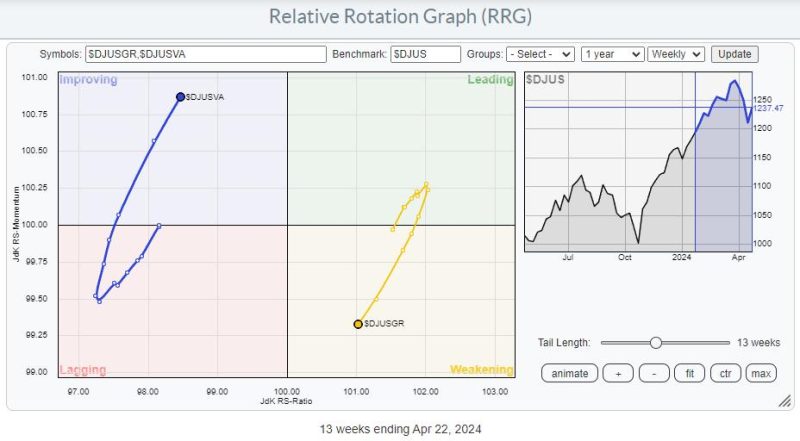

10. **Technical Indicators**: Technical analysis can provide valuable insights into market trends and potential price movements. Investors should pay attention to key technical indicators, such as moving averages, support and resistance levels, and momentum oscillators, to identify potential buying or selling opportunities and manage their risk effectively.

In conclusion, while the shift towards value stocks may present attractive investment opportunities, investors should be mindful of the downside risks that could impact their portfolios. By staying informed, conducting thorough research, and implementing risk management strategies, investors can navigate the challenges of the current market environment and position themselves for long-term success.