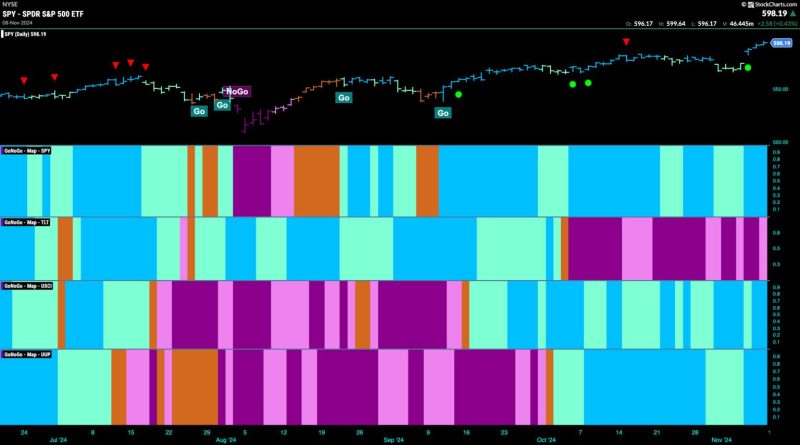

Equity-Go Trend Sees Surge in Strength as Financials Drive Price Higher

The Equity-Go trend has been making waves in the financial markets as the surge in strength continues, with financials driving prices higher. This trend has caught the attention of investors and analysts alike, drawing keen interest due to its significant impact on stock movements. Let’s delve into the factors behind this surge and how it is shaping the investment landscape.

Financials Take the Lead

One of the driving forces behind the Equity-Go trend surge is the strong performance of financial institutions. Banks and financial services companies have been on the rise, outpacing other sectors in terms of stock price appreciation. The Federal Reserve’s decision to maintain ultra-low interest rates has been a boon for financial stocks, as it helps improve their profitability and lending margins.

Increased Lending Activity

As the economy continues to recover from the repercussions of the pandemic, there has been a noticeable increase in lending activity. Banks are becoming more confident in extending credit, which bodes well for their bottom line. This uptick in lending is fueled by growing consumer and business demand, signaling a positive outlook for the economy and the financial sector in particular.

Tech Sector Resilience

While financials are leading the charge, the tech sector has also been displaying resilience in the face of this trend. Technology companies, particularly those focused on innovation and growth, have seen steady gains in their stock prices. These companies continue to be at the forefront of digital transformation and are well-positioned to benefit from the Equity-Go trend.

Diversification Strategies

Investors are increasingly turning to diversified strategies to capitalize on the Equity-Go trend. By spreading their investments across different sectors and asset classes, they aim to maximize returns while minimizing risk. This approach aligns with the unpredictability of the market and allows investors to benefit from the strengths of various sectors.

Global Implications

The Equity-Go trend surge is not restricted to a single market or region; its impact is felt globally. International investors are paying close attention to this trend and adjusting their portfolios accordingly. As financial institutions drive prices higher, investors around the world are looking for opportunities to capitalize on this momentum.

Risk Management

Despite the optimism surrounding the Equity-Go trend, investors are mindful of the importance of risk management. Volatility in the market remains a key concern, prompting investors to adopt prudent strategies to protect their capital. By carefully monitoring market conditions and staying informed, investors can navigate the fluctuations and make informed decisions.

In conclusion, the Equity-Go trend surge, fueled by the strength of financials and supported by increased lending activity, has brought a wave of excitement to the investment landscape. As investors navigate these uncertain times, diversification, resilience, and risk management are essential components of a successful investment strategy. By staying informed and proactive, investors can position themselves to benefit from the opportunities presented by this trend.