Secular Bull Market Continues but with Major Rotation

The global financial markets are currently in the midst of a secular bull market, characterized by long-term upward movements in stock prices punctuated by shorter-term fluctuations. However, the dynamics of this bull market have recently shifted, with major rotations occurring within various sectors and industries.

Traditionally, secular bull markets are propelled by strong economic fundamentals, low interest rates, and robust corporate earnings growth. These factors continue to provide a solid foundation for the ongoing bull market, which has been further supported by unprecedented fiscal and monetary stimulus in response to the economic challenges posed by the COVID-19 pandemic.

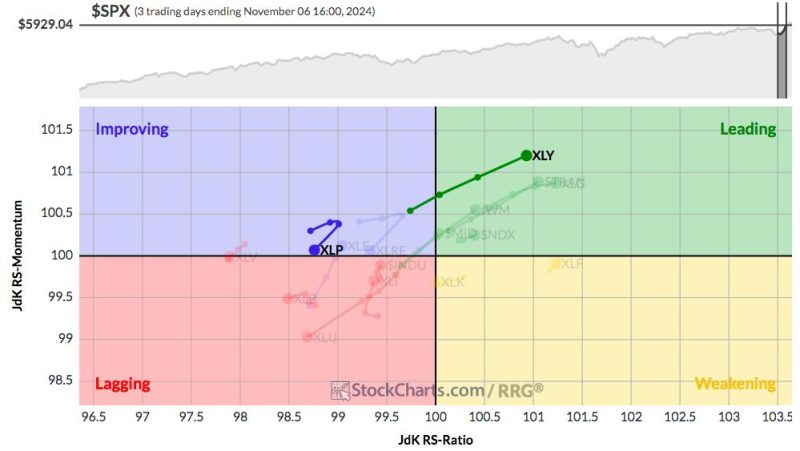

One of the notable features of the current secular bull market is the significant rotation that has taken place within the stock market. Historically, certain sectors such as technology, healthcare, and consumer discretionary have outperformed during bull markets. However, in recent months, there has been a notable shift away from these high-growth sectors towards more cyclical and value-oriented sectors such as financials, industrials, and energy.

This rotation can be attributed to several factors, including rising inflation expectations, a steepening yield curve, and increasing confidence in the economic recovery. As investors anticipate a return to pre-pandemic levels of economic activity, they are reallocating their capital towards sectors that stand to benefit the most from a reopening economy.

The rotation within the stock market has also been influenced by changing market dynamics and investor preferences. The surge in retail trading and the influence of social media platforms have contributed to increased volatility and speculative trading in certain pockets of the market. This has led to a reevaluation of traditional valuation metrics and a divergence between stock prices and underlying fundamentals.

Despite the ongoing rotation and changing market dynamics, the secular bull market is expected to persist in the medium to long term. The underlying economic recovery, coupled with accommodative monetary policy and continued fiscal stimulus, is likely to support further gains in stocks. However, investors should remain vigilant and adapt their investment strategies to navigate the evolving market environment.

In conclusion, the secular bull market continues to march forward, albeit with a major rotation in sector leadership and market dynamics. Investors should focus on diversification, risk management, and a long-term investment horizon to navigate the current environment successfully. By staying informed and agile, investors can capitalize on the opportunities presented by the ongoing bull market while mitigating potential risks.