In the dynamic world of stock market trading, it is essential for investors to keep a close eye on key indicators and upcoming events that could potentially impact market movements. The Nifty index, a key benchmark for Indian equity markets, is closely watched by traders and investors alike for signals on market direction and sentiment. As we look ahead to the upcoming trading week, there are key levels and factors to watch out for in order to gauge potential price action.

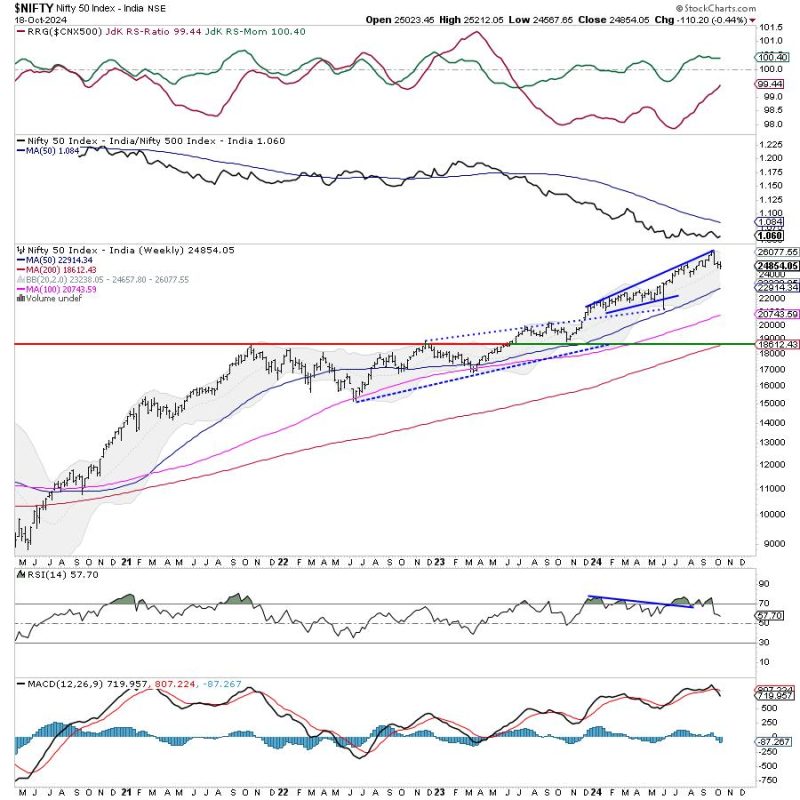

One of the key indicators to monitor when it comes to the Nifty index is the range within which it is trading. Range-bound trading occurs when the index moves within a specific price range without making significant breakouts or breakdowns. In the current scenario, it is anticipated that the Nifty may continue to trade within a defined range in the absence of any major catalysts or news events.

For traders looking to make profitable trades, it is crucial to identify potential breakout or breakdown levels that could lead to trending moves in the market. These edges can act as crucial entry and exit points for traders, providing valuable insights into potential price movements. By closely monitoring these levels, traders can position themselves strategically to capitalize on emerging trends and patterns in the market.

Technical analysis plays a vital role in identifying key support and resistance levels that could influence market dynamics. Traders often use technical indicators, chart patterns, and trend lines to forecast potential price movements and make informed trading decisions. By combining technical analysis with a thorough understanding of market fundamentals, traders can gain a competitive edge in navigating the complexities of the stock market.

Market sentiment also plays a significant role in driving price action in the Nifty index. Positive news flows, macroeconomic indicators, and global market trends can all impact investor sentiment and influence market movements. By staying informed about key developments and upcoming events, traders can stay ahead of the curve and anticipate potential market shifts.

In conclusion, the upcoming trading week for the Nifty index is likely to see range-bound trading, with trending moves expected only if key edges are breached. By closely monitoring technical indicators, key levels, and market sentiment, traders can position themselves strategically to capitalize on emerging opportunities in the market. As always, it is important for traders to exercise caution, conduct thorough research, and implement risk management strategies to navigate the ups and downs of the stock market successfully.