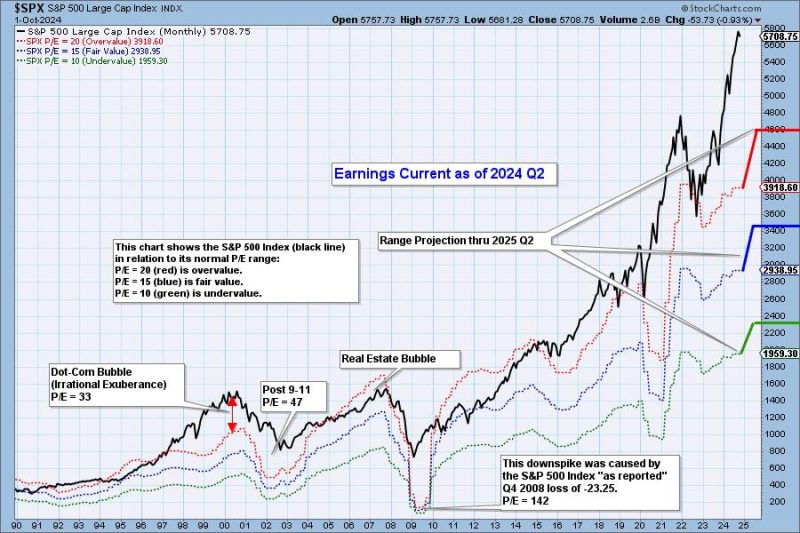

In the latest financial reports for the second quarter of 2024, many analysts are pointing out that the market seems to be very overvalued. This assessment comes amid a backdrop of significant economic uncertainty and volatility, casting doubts on the sustainability of current asset valuations.

One key factor contributing to the perception of an overvalued market is the disconnect between stock prices and underlying fundamentals. While stock prices have continued to soar to new heights, driven in part by unprecedented levels of fiscal and monetary stimulus, corporate earnings have not necessarily followed suit. This disjunction between stock prices and earnings raises concerns about the sustainability of current valuations.

Moreover, concerns around inflationary pressures and rising interest rates further compound the issue of overvaluation in the market. As central banks begin to tighten monetary policy to curb inflation, the cost of borrowing is expected to rise, which could dampen corporate profitability and weigh on stock prices. In such an environment, the disconnect between stock prices and fundamentals could become even more pronounced, leading to a potential correction in asset prices.

Another point of contention contributing to the perceived overvaluation is the exuberance and speculative behavior evident in certain segments of the market. The rise of meme stocks, cryptocurrencies, and other speculative assets has fueled concerns about a potential bubble in the market. The euphoria surrounding these assets has led to significant price discrepancies and valuations that are difficult to justify based on traditional metrics.

Furthermore, geopolitical risks and global macroeconomic uncertainties add another layer of complexity to the overvaluation debate. Ongoing trade tensions, political instability, and the resurgence of the pandemic in certain regions create an unpredictable environment that could prompt a sudden reassessment of risk assets.

In conclusion, while the market has enjoyed a strong rally in recent years, fueled by a combination of unprecedented stimulus and investor exuberance, the current environment appears to be very overvalued. The widening gap between stock prices and fundamentals, coupled with inflationary pressures, rising interest rates, and speculative behavior, raises concerns about the sustainability of current valuations. As investors navigate these uncertain waters, it is important to exercise caution and prudence in managing investment portfolios to mitigate potential risks associated with an overvalued market.