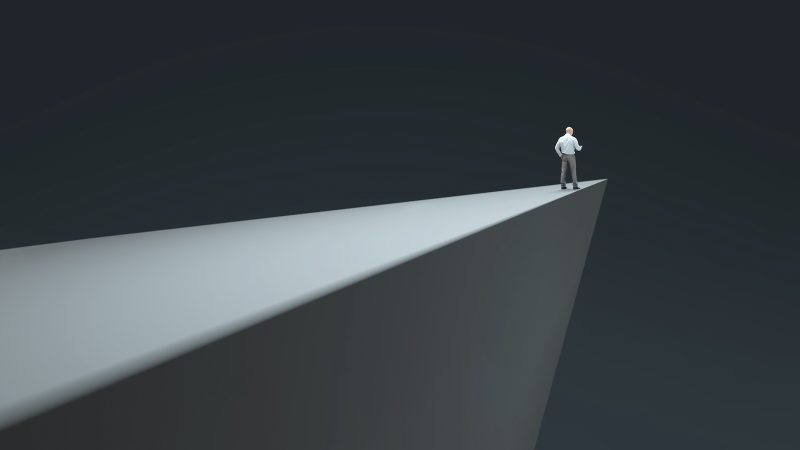

As the Nasdaq teeters on the edge, it’s crucial for investors to pay close attention to key critical levels that may dictate the market’s next moves.

First and foremost, the Nasdaq Composite Index has been displaying signs of vulnerability, with recent fluctuations causing concern among market participants. At the time of writing, the index is hovering near a pivotal support level, indicating a potential inflection point in market sentiment.

One critical level to watch closely is the 50-day moving average, which is a widely followed technical indicator that helps gauge the market’s momentum and trend direction. A breach below this level could signal further downside pressure, potentially leading to increased selling activity and a deeper correction in the market.

In addition to the 50-day moving average, traders are also keeping a keen eye on the 200-day moving average as another significant support level. A break below this long-term indicator would likely trigger heightened volatility and exacerbate the selling pressure, potentially pushing the Nasdaq into a more pronounced downtrend.

Furthermore, short-term traders and technical analysts are closely monitoring key Fibonacci retracement levels, which serve as crucial markers of potential support or resistance. These levels are derived from key price points and tend to act as significant turning points in the market when approached.

Amidst the current uncertainties and market volatility, investors are advised to remain cautious and vigilant, closely monitoring these critical levels to make informed decisions about their portfolio strategies. Mitigating risks and implementing sound risk management practices are essential during times of heightened market turbulence.

In conclusion, the Nasdaq’s precarious position underscores the importance of monitoring critical support and resistance levels to navigate the ever-changing landscape of the financial markets. By staying informed and responsive to market dynamics, investors can position themselves more effectively to weather potential storms and capitalize on emerging opportunities.