In the fast-paced world of finance, trends and patterns can change rapidly, impacting the performance of equities and other financial instruments. Recent market movements have seen a shift in the balance of power, with financials beginning to outperform as the trend in equities weakens.

One clear indicator of this shift is the performance of financial stocks compared to the broader market. Financial institutions have been reporting strong earnings and growth, driven by factors such as increased interest rates and a robust economy. This positive performance has attracted investors seeking opportunities for high returns in a changing market environment.

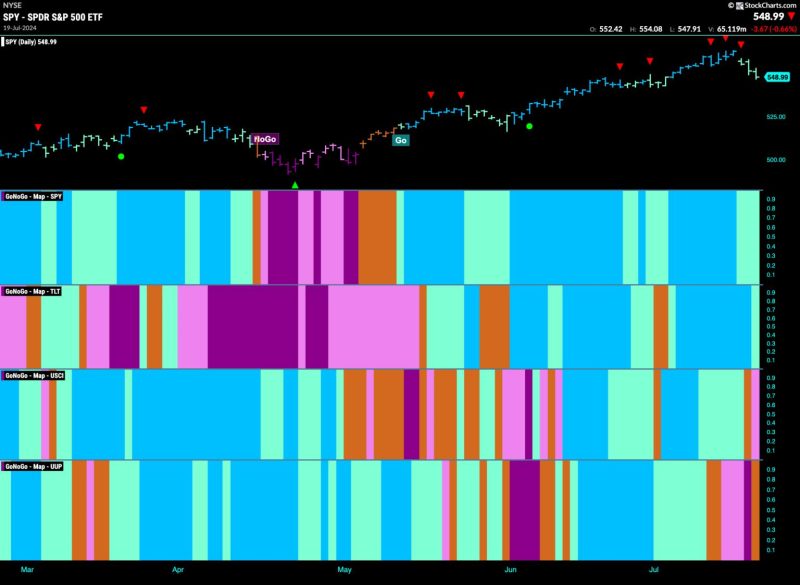

On the other hand, equities have started to show signs of weakening. After a prolonged period of growth and record highs, some investors have become wary of inflated valuations and the potential for a market correction. This has led to increased volatility in the equity markets, prompting some investors to reallocate their investments into more stable and defensive sectors such as financials.

The divergence between financials and equities can also be attributed to changing investor sentiment and market dynamics. As economic conditions evolve and geopolitical uncertainties persist, investors are reevaluating their investment strategies to navigate potential risks and seize new opportunities. This shift in investor behavior has contributed to the outperformance of financials relative to equities in recent months.

Looking ahead, it remains crucial for investors to monitor market developments and assess the implications for their investment portfolios. While financials may continue to outperform in the short term, market conditions can change rapidly, necessitating a flexible and adaptive investment approach. By staying informed and proactive, investors can position themselves to navigate changing market trends and capitalize on emerging opportunities in the financial sector and beyond.