Sector Rotation Model Flashes Warning Signals

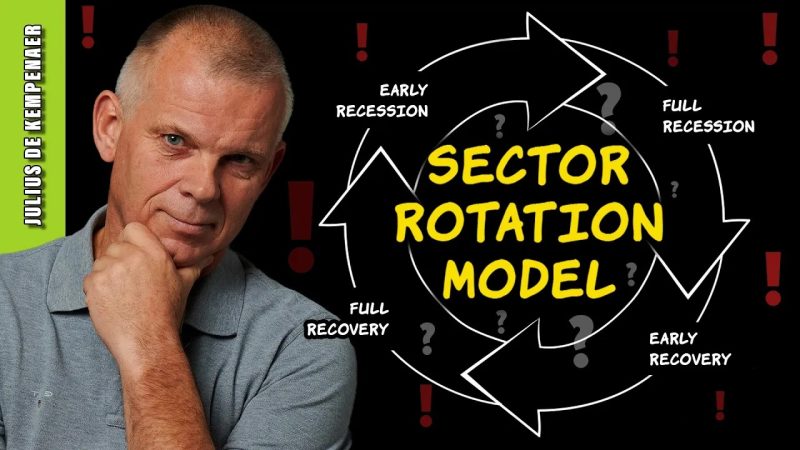

The sector rotation model is a powerful tool used by investors to identify sectors that are likely to outperform or underperform the market. By monitoring the relative strength of various sectors, investors can adjust their portfolios to capitalize on shifting market trends. However, the sector rotation model is not foolproof, and there are times when it can give false signals or fail to accurately predict market movements.

Stock market investors rely on various tools and indicators to make informed investment decisions. One such tool is the sector rotation model, which helps investors identify trends in different sectors of the economy. The model is based on the idea that different sectors perform well at different stages of the economic cycle. By analyzing the relative strength of various sectors, investors can determine which sectors are likely to outperform or underperform the market as a whole.

In recent weeks, the sector rotation model has been flashing warning signals to investors. One of the key indicators used in the model is the performance of the technology sector. Technology stocks have been volatile in recent months, with many investors concerned about the high valuations of some of the leading tech companies. The sector rotation model has been signaling that technology stocks may be due for a pullback, which could have a significant impact on the broader market.

Another sector that investors are watching closely is the energy sector. Energy stocks have been under pressure in recent months, as concerns about oversupply and weakening demand have weighed on the sector. The sector rotation model has been indicating that energy stocks may continue to underperform, which could be a bearish signal for the overall market.

Despite the warning signals being flashed by the sector rotation model, investors should be cautious about making significant changes to their portfolios based on this information alone. The model is just one tool among many that investors can use to make informed decisions. It is important to consider a variety of factors, including economic data, company fundamentals, and market sentiment, when making investment decisions.

In conclusion, the sector rotation model is a valuable tool that can help investors identify trends in different sectors of the economy. However, it is not infallible, and investors should be cautious about making major portfolio decisions based solely on its signals. By carefully weighing a variety of factors, investors can make more informed investment decisions and better navigate the ups and downs of the stock market.