The Hindenburg Omen Flashes an Initial Sell Signal

The stock market is a complex and dynamic system that is influenced by a myriad of factors. One such tool used by traders and analysts to forecast market trends is the Hindenburg Omen. Named after the infamous Hindenburg airship disaster, this technical indicator is designed to identify potential stock market crashes or corrections by detecting market breadth divergences.

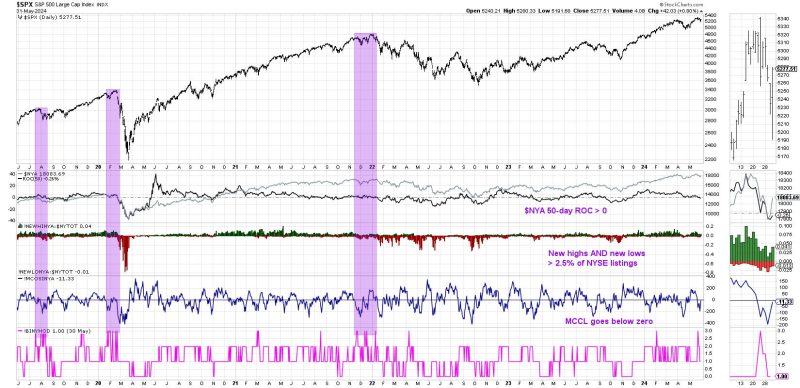

The Hindenburg Omen is triggered when a series of market conditions align, signaling a high probability of a downturn in the stock market. These conditions include a rising number of stocks hitting new highs and new lows simultaneously, as well as a weakening of the McClellan Oscillator, an indicator that measures market momentum. When these factors converge, it creates a bearish signal that suggests a potential sell-off in the market.

The recent flashing of the Hindenburg Omen has caught the attention of investors and analysts alike. As global economic uncertainties persist and geopolitical tensions escalate, the potential for market volatility and downside risks has increased. The Hindenburg Omen serves as a warning sign for traders to exercise caution and implement risk management strategies to protect their investments.

While the Hindenburg Omen has a mixed track record of accuracy, it is still considered a valuable tool in the arsenal of technical analysis. Traders use this indicator in conjunction with other market signals and fundamental analysis to make informed decisions about their investment portfolios. It is essential to approach market indicators with a comprehensive understanding of their limitations and potential biases to avoid relying solely on one tool for investment decisions.

In conclusion, the Hindenburg Omen flashing an initial sell signal serves as a reminder of the inherent uncertainties and risks in the stock market. Traders and investors must remain vigilant, stay informed, and be prepared to adapt to changing market conditions. By incorporating a diversified approach to investment strategies and utilizing various tools and indicators, investors can navigate volatile market environments with greater confidence and resilience.