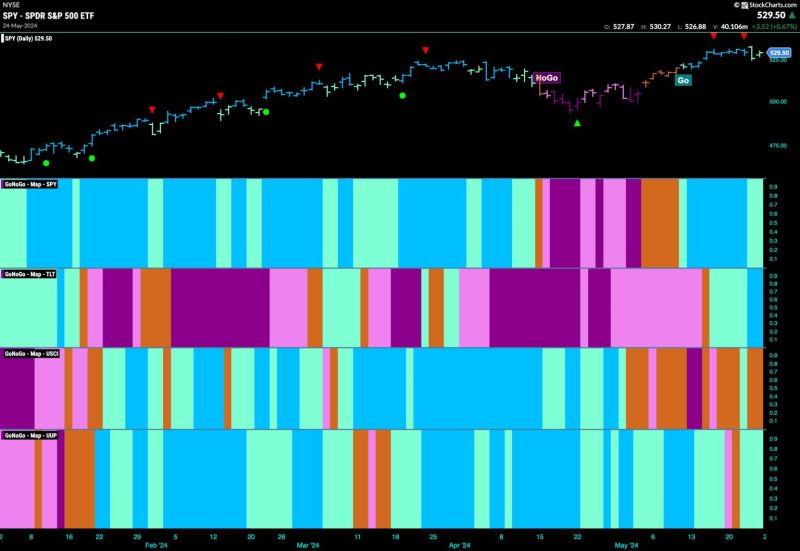

Equities Remain in Go Trend with Sparse Leadership from Tech and Utilities

The stock market continues its upward trajectory, showing remarkable resilience even in the face of uncertainties and challenges. Tech and utilities sectors, the stalwarts that have traditionally led the charge, are now displaying more subdued performance compared to other sectors.

Amidst this landscape of evolving trends, investors are strategizing and adapting to capitalize on opportunities for growth and profitability. Let’s delve deeper into the dynamics at play within equities markets and explore the implications for investors.

1. **Shift in Sector Leadership**: The traditional leaders of the stock market, technology and utilities, have taken a backseat as other sectors emerge as new frontrunners. Sectors such as healthcare, consumer goods, and industrials have shown strong potential for growth, enticing investors with attractive opportunities.

2. **Tech Sector Deceleration**: The tech sector, a long-time favorite of investors, is experiencing a period of deceleration. This shift is partly due to concerns over valuations and regulatory scrutiny faced by tech giants. Investors are diversifying their portfolios and seeking out alternative sectors for robust returns.

3. **Utility Sector Consolidation**: The utility sector, known for its stability and defensive characteristics, is undergoing consolidation as companies look for avenues to enhance efficiency and capitalize on economies of scale. This sector remains crucial for investors seeking steady income streams and protection against market volatility.

4. **Emerging Sectors**: Sectors such as renewable energy, e-commerce, and biotechnology are on the rise, presenting investors with exciting growth prospects. These emerging sectors are at the forefront of innovation and are poised to capitalize on changing consumer preferences and technological advancements.

5. **Investor Strategies**: In light of the evolving sector dynamics, investors are reassessing their strategies to align with the changing market landscape. Diversification across sectors, active portfolio management, and a focus on emerging trends are key strategies being employed to navigate the current market environment.

6. **Global Outlook**: The global economic landscape continues to impact equities markets, with geopolitical events, trade tensions, and central bank policies influencing investor sentiment. A comprehensive understanding of global market dynamics is essential for investors looking to make informed decisions and optimize their investment portfolios.

7. **Risk Management**: With market volatility and uncertainties prevailing, risk management is paramount for investors. Implementing risk mitigation strategies, conducting thorough due diligence, and staying informed about market developments are crucial steps to safeguard investment portfolios against potential downside risks.

In conclusion, the equities market remains dynamic and ever-evolving, offering both opportunities and challenges for investors. By staying informed, adopting a diversified approach, and remaining vigilant in their investment strategies, investors can position themselves to capitalize on market trends and achieve long-term financial success.