The Stock Market Rollercoaster: Navigating Volatility and Leveraged Exposures

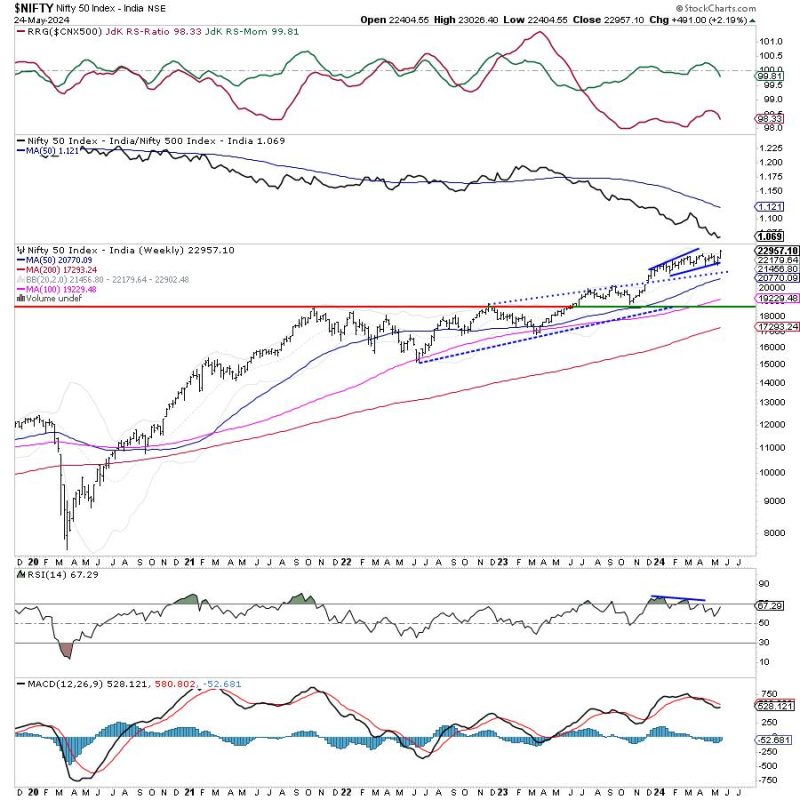

Understanding the intricacies of the stock market can often feel like riding a rollercoaster. This sentiment is especially true in volatile times when market movements can drastically impact investment portfolios. The Nifty, a popular benchmark index in the Indian stock market, holds immense influence over trading sentiment and strategies. As highlighted in recent analysis, the Nifty is expected to move within a volatile range in the upcoming period, prompting the need for investors to adopt cautious and well-thought-out approaches.

Leveraged exposures, a common strategy among investors looking to amplify their potential returns, are also under scrutiny. While leveraging can significantly enhance profits during favorable market conditions, it can expose investors to heightened risks, particularly in turbulent times. As the market gears up for what promises to be a period of potential turbulence, curtailing leveraged exposures is a prudent move that can prevent significant losses and protect capital.

The impact of global events and economic indicators on the stock market cannot be understated. External factors, such as geopolitical tensions, natural disasters, and macroeconomic trends, can create ripples in the market, leading to rapid fluctuations in prices. These variables add layers of complexity to investment decisions, requiring investors to stay vigilant and proactive in their strategies.

In times of high volatility, it is essential for investors to diversify their portfolios effectively. Diversification spreads risk across different asset classes and sectors, reducing the impact of isolated market movements on the overall portfolio. By investing in a mix of stocks, bonds, and other financial instruments, investors can cushion the impact of market volatility and potentially enhance long-term returns.

Risk management is a crucial aspect of navigating volatile market conditions. Setting stop-loss orders, maintaining adequate liquidity, and periodically reviewing investment positions can help investors mitigate potential losses and capitalize on emerging opportunities. With prudent risk management practices in place, investors can weather market storms with greater resilience and adaptability.

As the Nifty prepares to embark on a journey within a volatile range, investors are urged to exercise caution, restraint, and prudence in their decision-making. By understanding the dynamics of the stock market, monitoring global events, implementing effective risk management strategies, and diversifying portfolios, investors can position themselves for success in an unpredictable and ever-changing market environment.

In conclusion, navigating volatility and leveraged exposures in the stock market requires a combination of foresight, diligence, and adaptability. By staying informed, implementing prudent risk management practices, and diversifying portfolios, investors can navigate turbulent market conditions with confidence and resilience. As the market landscape continues to evolve, embracing a cautious and strategic approach can help investors weather uncertainties and pursue long-term financial growth.