In the fast-paced world of investment opportunities, one metal that is gaining attention is tin. Considered a critical element in various industries, such as electronics, packaging, and construction, tin has presented itself as a lucrative investment option. This guide will explore how investors can effectively invest in tin stocks in 2024 and make informed decisions to potentially maximize returns.

Understanding the Tin Market

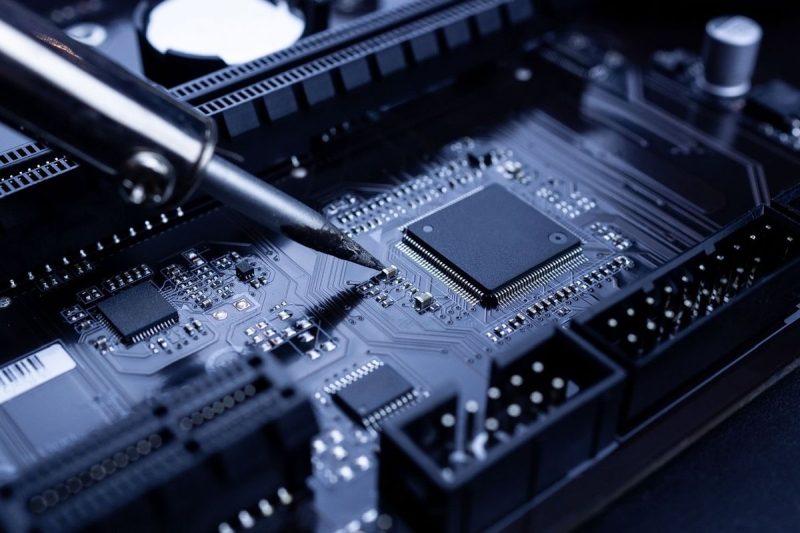

Tin is a versatile metal commonly used in the production of solders, tinplate, chemicals, and as a coating for other metals to prevent corrosion. With its high conductivity and resistance to corrosion, tin is integral to the electronics industry, particularly in the manufacturing of circuit boards and electronic components. The increasing demand for electronic devices globally has fueled the demand for tin, making it an attractive commodity for investors.

Factors Influencing Tin Prices

Investors looking to invest in tin stocks must be cognizant of the various factors that can influence tin prices. The supply-demand dynamics of the global tin market play a significant role in determining the metal’s price. Factors such as production levels, geopolitical issues in major tin-producing countries, and changes in consumption patterns can all impact tin prices. Additionally, macroeconomic factors like inflation, interest rates, and currency fluctuations can also affect the market price of tin.

Researching Tin Stocks

Before investing in tin stocks, conducting thorough research is essential to identify lucrative opportunities. Investors should analyze the financial health of tin mining companies, their production levels, reserve estimates, and growth prospects. Keeping abreast of industry developments, such as new technological advancements in tin mining and processing, can also provide valuable insights for making informed investment decisions.

Diversification and Risk Management

As with any investment, diversification is key to managing risk effectively. Investors should consider diversifying their tin investment portfolio by including a mix of tin mining companies or investing in tin-focused exchange-traded funds (ETFs). Diversification helps spread risk and potentially enhance returns by tapping into different aspects of the tin market.

Monitoring Market Trends

Staying informed about market trends and developments is crucial for investors in the tin market. Regularly monitoring tin prices, supply-demand dynamics, geopolitical events, and technological advancements can provide valuable insights into the market’s trajectory. Utilizing financial news platforms, industry reports, and expert analysis can help investors make informed decisions and navigate market volatility effectively.

Seeking Professional Advice

For novice investors or those unfamiliar with the intricacies of the tin market, seeking professional advice from financial advisors or investment experts is recommended. Experienced professionals can provide personalized guidance based on individual investment goals, risk tolerance, and market conditions. Consulting with industry experts can help investors build a robust investment strategy tailored to their specific needs and objectives in the tin market.

In conclusion, investing in tin stocks can offer lucrative opportunities for investors looking to diversify their portfolio and capitalize on the metal’s significance in various industries. By understanding the tin market, researching tin stocks, diversifying investments, monitoring market trends, and seeking professional advice, investors can navigate the complexities of the market and potentially reap rewards from their tin investments.