Investing in Chromium Stocks in 2024: A Comprehensive Guide

Understanding Chromium and its Market Potential

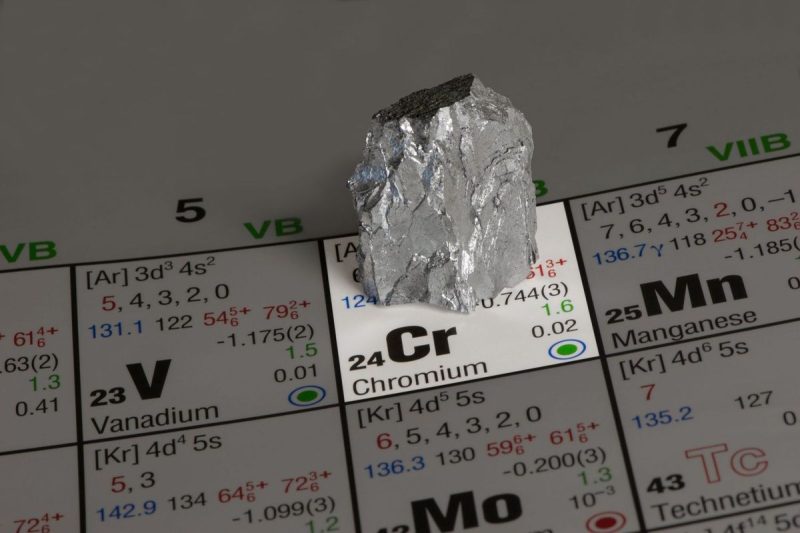

Before delving into the specifics of investing in Chromium stocks in 2024, it is crucial to understand what Chromium is and its market potential. Chromium is a versatile metal used in various industries, including stainless steel production, the aerospace industry, and green energy technologies. With the increasing demand for stainless steel and the development of sustainable energy sources, Chromium is poised for significant growth in the coming years.

Factors Affecting Chromium Prices and Demand

Several factors influence the price and demand for Chromium, making it essential for investors to stay informed about market trends. One of the primary factors affecting Chromium prices is global demand for stainless steel, as Chromium is a key component in its production. Additionally, geopolitical factors, trade agreements, and environmental regulations can also impact Chromium prices and market dynamics.

Analyzing Chromium Stocks and Companies

When considering investing in Chromium stocks, investors should conduct thorough research on the companies involved in Chromium mining, production, and distribution. It is crucial to assess the financial health, market position, and growth potential of these companies to make informed investment decisions. Some of the top Chromium-related companies to watch in 2024 include Compagnie de Saint-Gobain, Glencore Plc, and SAMANCOR Chrome.

Diversification and Risk Management Strategies

Diversification is a key strategy for investors looking to minimize risk when investing in Chromium stocks. By spreading investments across multiple companies in the Chromium industry or combining them with investments in other sectors, investors can reduce the impact of market fluctuations on their overall portfolio. Moreover, monitoring market trends, staying updated on industry news, and setting clear investment goals are essential for effective risk management in Chromium stock investments.

Long-Term Growth Prospects and Investment Opportunities

Despite the potential risks associated with investing in Chromium stocks, the metal’s long-term growth prospects present attractive investment opportunities for savvy investors. As the demand for stainless steel continues to rise and green energy technologies gain traction, Chromium stocks are likely to experience steady growth over the coming years. By staying informed about market trends, conducting thorough research, and employing sound investment strategies, investors can capitalize on the lucrative opportunities offered by the Chromium market in 2024 and beyond.

In conclusion, investing in Chromium stocks in 2024 can be a rewarding venture for investors seeking exposure to a diverse and dynamic industry. By understanding the factors influencing Chromium prices, analyzing Chromium-related companies, diversifying investments, and managing risks effectively, investors can position themselves to benefit from the long-term growth prospects in the Chromium market. With careful planning and strategic decision-making, investing in Chromium stocks can potentially yield attractive returns for investors in the years to come.