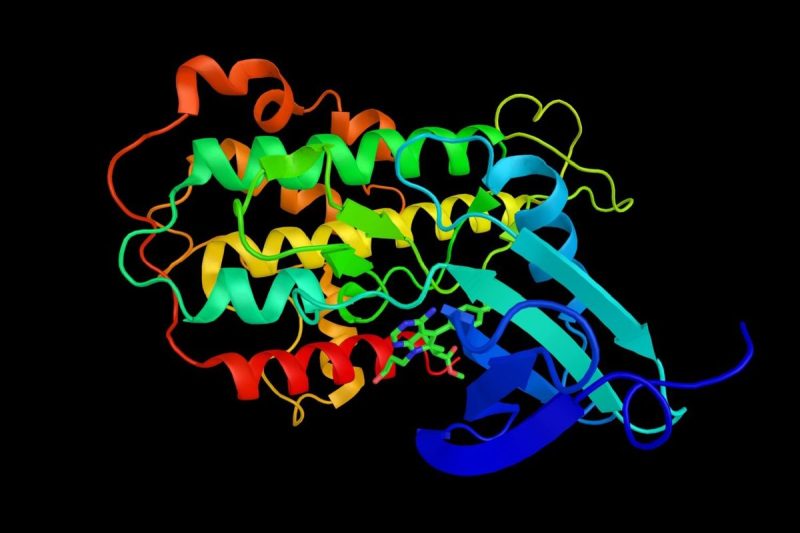

In the rapidly evolving world of technology, artificial intelligence has emerged as a game-changer across various industries. One company at the forefront of AI development is DeepMind Technologies, the creator of the revolutionary AlphaFold algorithm. AlphaFold is an AI system that uses deep learning to predict protein structures, with significant implications for drug discovery, biology, and healthcare. This cutting-edge technology has generated significant buzz in the investment community, piquing the interest of many looking to capitalize on its potential for growth.

Investing in AlphaFold stock presents a unique opportunity to tap into the fast-growing field of artificial intelligence and biotechnology. While purchasing shares in a specific technology like AlphaFold can be complex, with a solid investment strategy and understanding of the market dynamics, investors can potentially reap significant rewards in the long run.

Before diving headfirst into investing in AlphaFold stock, it is crucial to conduct in-depth research on the company, its products, services, and financial health. Understanding the market landscape, competitive positioning, and growth prospects of AlphaFold can help investors make informed decisions and mitigate risks associated with investing in a high-growth, high-risk sector.

Furthermore, evaluating the broader trends shaping the AI and biotechnology industries can provide valuable insights into the growth potential of AlphaFold stock. Keeping abreast of developments in protein structure prediction, drug discovery, and healthcare innovation can help investors assess the market demand for AlphaFold’s technology and its competitive advantage.

In addition to market research, investors should also consider the financial performance and valuation of AlphaFold as a company. Analyzing key financial metrics, such as revenue growth, profitability, and cash flow, can give investors a clearer picture of the company’s financial health and growth trajectory. Valuing AlphaFold stock based on industry comparables, growth projections, and discounted cash flow analysis can help investors estimate the intrinsic value of the stock and make informed investment decisions.

It is also important for investors to diversify their investment portfolios to mitigate risks associated with investing in individual stocks. Allocating a portion of the investment portfolio to high-growth sectors like AI and biotechnology can provide investors with exposure to potential upside while balancing risks across different asset classes and industries.

In conclusion, investing in AlphaFold stock offers investors the opportunity to tap into the growth potential of artificial intelligence and biotechnology. By conducting thorough research, understanding market dynamics, and assessing the financial performance of the company, investors can make informed decisions and potentially benefit from the long-term growth prospects of AlphaFold. With a disciplined investment strategy and a diversified portfolio, investors can position themselves to capitalize on the transformative power of AI and biotechnology in the years to come.