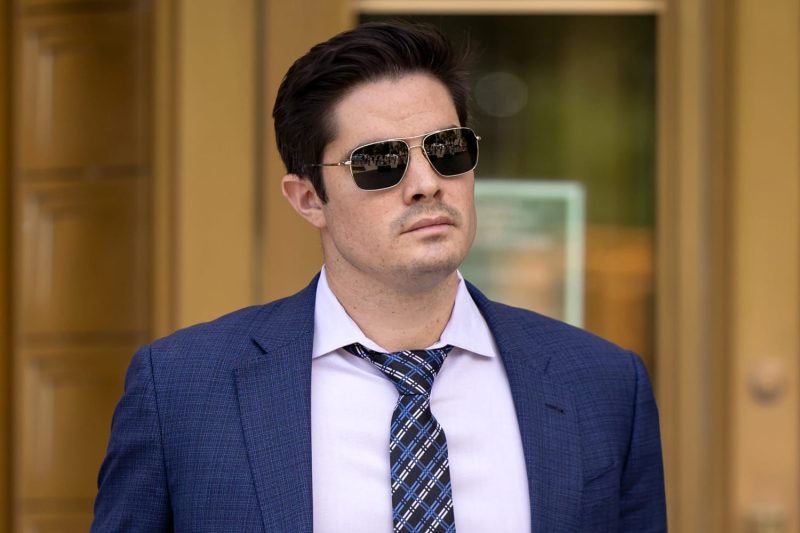

In a recent turn of events, the former FTX executive who reportedly turned on the cryptocurrency exchange’s CEO Sam Bankman-Fried has been sentenced to 7.5 years in prison. This case sheds light on the complexities and risks inherent in the world of cryptocurrency. The story unveils a narrative of betrayal, fraud, and consequences, reminding us of the high stakes involved in this rapidly evolving industry.

The downfall of the former FTX executive serves as a cautionary tale for others in the cryptocurrency space. It highlights the importance of transparency, ethical conduct, and adherence to legal regulations. In a sector known for its decentralized nature and lack of traditional oversight, cases like this underscore the need for accountability and integrity.

The sentencing of the executive also raises questions about the potential vulnerabilities within cryptocurrency companies. As the industry continues to expand and attract more mainstream attention, issues related to security, compliance, and internal controls become crucial areas of focus. Companies operating in this space must prioritize robust measures to prevent fraud, protect investors, and uphold trust in the integrity of the market.

The case also underscores the interconnected nature of the cryptocurrency ecosystem. The actions of individuals within the industry can have far-reaching consequences, impacting not only the companies involved but also the broader community of investors and stakeholders. As such, maintaining a culture of accountability and responsibility is essential for the sustained growth and legitimacy of the cryptocurrency sector.

Moreover, the sentencing of the former FTX executive serves as a reminder of the importance of due diligence when evaluating potential partnerships and collaborations within the industry. Trust is a fragile yet invaluable asset in the world of cryptocurrency, and any breach of that trust can have severe repercussions. Companies and investors must exercise caution, conduct thorough background checks, and be vigilant in detecting any signs of misconduct or dishonesty.

In conclusion, the case of the former FTX executive sentenced to 7.5 years in prison serves as a sobering reminder of the risks and consequences associated with the cryptocurrency industry. As the sector continues to evolve and mature, maintaining high ethical standards, promoting transparency, and adhering to legal regulations will be essential for building trust, credibility, and resilience. Only by learning from such incidents and implementing robust governance mechanisms can the cryptocurrency industry navigate its way towards a more secure and sustainable future.