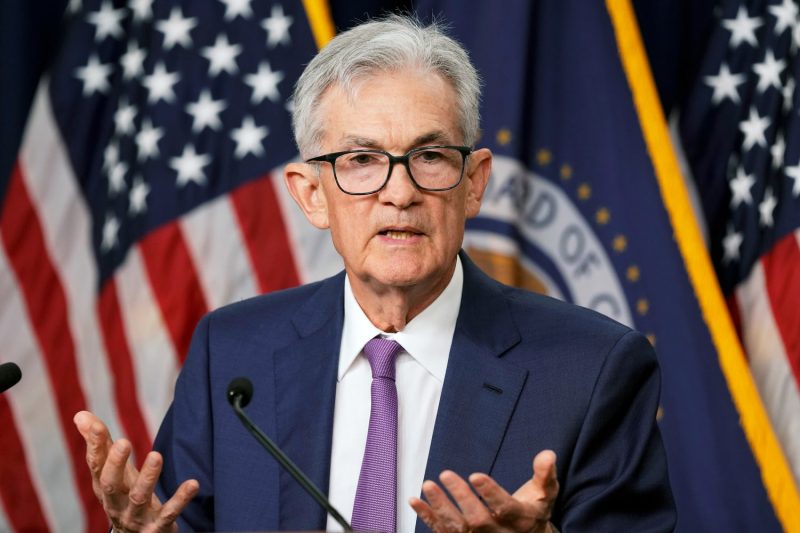

Federal Reserve Chair Jerome Powell recently made a significant announcement regarding inflation rates in the US. Powell stated that inflation has been higher than previously anticipated and that he expects interest rates to remain steady. This news is of great importance to the economy as inflation and interest rates are key factors that influence consumer behavior, investment decisions, and overall economic performance. Powell’s comments highlight the challenges and complexities faced by central banks in managing monetary policy during times of uncertainty and rapid changes in economic conditions.

Inflation is a measure of the rate at which the general level of prices for goods and services is rising, eroding purchasing power. While some level of inflation is necessary for a healthy economy, high or volatile inflation can have negative consequences such as reducing consumer purchasing power, disrupting financial markets, and affecting the value of assets. Powell’s acknowledgment that inflation has been higher than initially thought suggests that there may be underlying factors contributing to the unexpected rise in prices.

One possible explanation for the higher inflation rates could be related to the ongoing supply chain disruptions caused by the global pandemic. The pandemic has severely impacted global trade and production, leading to shortages of key goods and materials. These supply chain disruptions have increased costs for businesses, which are then passed on to consumers in the form of higher prices. Additionally, the rapid recovery in consumer demand as economies reopen may also be contributing to inflationary pressures.

In response to the higher-than-expected inflation rates, Powell indicated that the Federal Reserve will hold interest rates steady. Interest rates play a crucial role in influencing borrowing costs, investment decisions, and overall economic activity. By keeping interest rates stable, the Federal Reserve aims to support economic growth while also managing inflationary pressures. However, striking the right balance between stimulating economic activity and controlling inflation remains a delicate and challenging task for policymakers.

Powell’s comments underscore the importance of transparency and communication in central bank policymaking. Clear and timely communication from central bank officials helps to manage expectations and provide guidance to market participants, businesses, and consumers. Powell’s acknowledgment of the higher inflation rates and the decision to keep interest rates steady signals to the market that the Federal Reserve is closely monitoring economic conditions and is prepared to take appropriate action if necessary.

In conclusion, Federal Reserve Chair Jerome Powell’s statement regarding higher-than-expected inflation rates and the decision to hold interest rates steady highlights the complexities and challenges faced by central banks in managing monetary policy. As the global economy continues to recover from the impacts of the pandemic, policymakers must navigate a complex environment of supply chain disruptions, changing consumer behavior, and inflationary pressures. Clear communication and proactive policymaking are essential to guiding the economy towards sustainable growth while maintaining price stability.