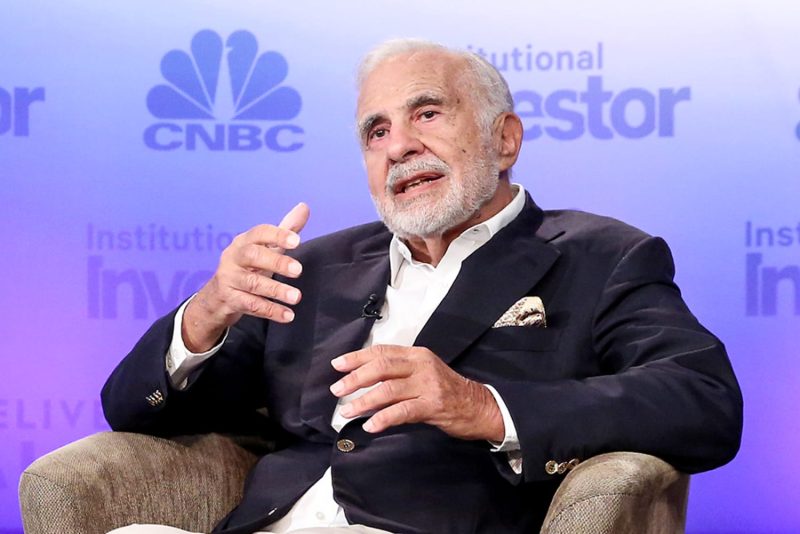

In the world of finance, individuals like Carl Icahn are often seen as influential figures in shaping markets and making bold investment decisions. However, a recent development has brought the spotlight onto Icahn, revealing a controversy surrounding the alleged hiding of billions of dollars’ worth of stock pledges. This has led to the Securities and Exchange Commission (SEC) filing charges against the prominent investor.

The SEC accuses Icahn of failing to disclose his stock pledges as required by federal securities laws. Stock pledges are essentially assets used as collateral for loans, and they are considered material information that should be made known to the public. The SEC’s charges claim that Icahn concealed these pledges, which amounted to billions of dollars, in filings with the agency.

The implications of these allegations are significant, as they raise questions about transparency and accountability in the financial sector. Investors rely on accurate and timely information to make informed decisions, and any attempts to hide such crucial details can undermine the integrity of the markets.

Icahn’s reputation as a savvy investor and corporate raider has made him a prominent figure on Wall Street. His investment strategies and outspoken nature have earned him both admirers and critics over the years. However, this latest legal action by the SEC casts a shadow over his legacy and raises concerns about his compliance with regulatory requirements.

It is essential for all market participants, regardless of their stature, to adhere to the rules and regulations that govern the financial industry. Transparency and integrity are fundamental principles that underpin the functioning of capital markets, and any violations of these principles can have far-reaching consequences.

As the case against Icahn unfolds, it will be closely watched by investors, regulators, and the public. The outcome of this legal battle will not only have implications for Icahn personally but also for the broader financial community. It serves as a reminder that no one is above the law, and all market participants must uphold the highest standards of ethical conduct.

In conclusion, the SEC’s charges against Carl Icahn for allegedly hiding billions of dollars’ worth of stock pledges shine a light on the importance of transparency and compliance in the financial industry. This case serves as a cautionary tale for investors and highlights the need for strict adherence to regulatory requirements to maintain the integrity of the markets. The resolution of this legal dispute will undoubtedly have far-reaching implications for all stakeholders involved.